For the first time financial statements will be prepared on new terms—are you ready?

The changes introduced to the Act on the National Court Register and the Accounting Act in 2018 entailed some changes in the terms of filing and also preparing financial statements. For most companies this may prove one of the most serious legal and accounting challenges in the first half of 2019. But if you appropriately prepare for this process, you may come through the closing of a financial year in a fast and easy manner. Still, you need to provide for the issues discussed below. And since the closest important date falls on 31 March 2019—which marks the deadline for filing financial statements—there is actually no much time to wait with the preparations.

Whether and how much the process of preparing and filing statements will be problematic for a company depends on whether any of the management board members is a foreigner without a Personal Identification Number PESEL. Companies facing such situation should in the first place become familiar with the text below.

How to sign and file statements and other documents

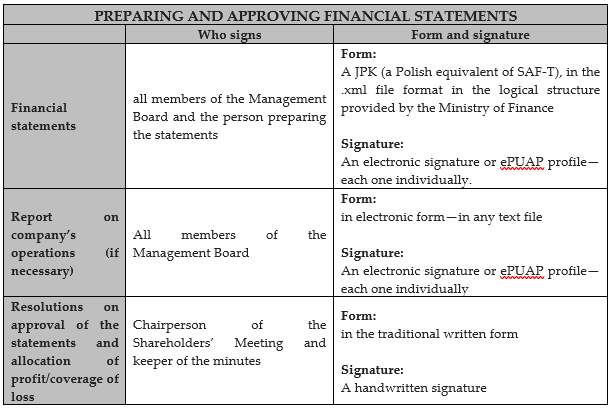

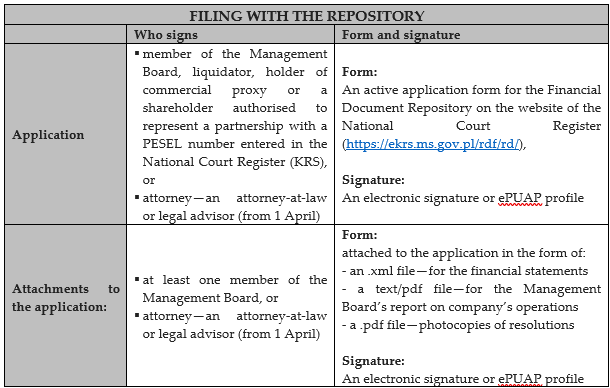

In view of amendments to the Act, you should take into consideration two stages which may be problematic for companies:

- preparing financial statements,

- filing financial statement with the Financial Document Repository.

Each of such filings is subject to requirements as provided in the tables below:

How to prepare—important remarks:

A few remarks to the foregoing explanations which may help you decide what actions connected with preparing and filing statements you will soon undertake:

- Problem with no PESEL number—an important change since 1 April 2019

- Problem: currently if a person without a PESEL number (entered in the National Court Register KRS) is the sole member of the Management Board, the company may not file financial statements with the Financial Document Repository.

- Solution: this problem will become out of date after 1 April 2019 when attorneys will become authorised to make filings for a company. An alternative solution is to appoint a special member of the Management Board or holder of commercial proxy and enter such person, along with the PESEL number, to the National Court Register—yet it is burdensome and requires mutual trust, so such scenario should be taken into account only if the company has to file the statements before 1 April.

- Remarks: it seems all the more advisable that a foreigner obtains a PESEL number and is entered in the National Court Register as it may considerably facilitate communication between the company and the Register, as well as other offices. Still, for this purpose the foreigner would have to create a trusted profile ePUAP. Insofar as the foreigner may obtain a PESEL relatively quickly (within a week, up to a month) and affordably (for PLN 17) through an attorney-in-fact, in order to verify the ePUAP profile the foreigner would have to visit an office or other competent institution in Poland (e.g. a bank outlet).

- Electronic signature—to be urgently obtained by the foreigner

- Problem: each member of the Management Board has to have a trusted profile ePUAP or an electronic signature (after the introduction of new ID cards there will also appear an alternative one, the so-called personal signature). Only by means of those instrument such person will be able to sign the financial statements and the Management Board’s report on company’s operations, and as a consequence the company managed by such person will be able to sign and file the financial statements with the Repository. ALL members of the Management Board holding their positions upon preparing and filing the statements have to have an ePUAP or electronic signature.

- Solution: a foreigner who is a Management Board member and does not want to obtain an ePUAP profile should obtain an electronic signature. Even if from interpretation of law it results that such signature should be certified in Poland or within the European Union, in its official announcements the Ministry of Justice confirmed that it acknowledges also electronic signatures certified beyond the EU—but they have to be compliant with the XAdES format. In order to obtain such signature in Poland or EU member states, the concerned person has to visit an entity giving the signature to verify his/her identity. The price for such signature in Poland does not exceed PLN 350.

- Problems with ePUAP—currently not valid, but it is worth being careful

- Problem: until recently, the software used to decrypt signed financial documents in the Repository could not read the encryption key correctly if the financial statements were signed with a trusted profile ePUAP, and as a result rejected the application filed so.

- Currently: IT services of the ministry have coped with the problem and now statements signed with an ePUAP are accepted by the Repository. Still, you should take into account such situations— filling the statements may be temporary hindered or prevented due to problems with the IT system, in particular in the period when traffic on the website is more intense around the end of June/beginning of July. But it seems that there is no good solution for this.

Advantages from the changes you should remember

- Filings with the Repository are free of charge,

- There is no need to file financial statements with tax offices—such information will be provided through the repository